LA R-1086 2017-2024 free printable template

Show details

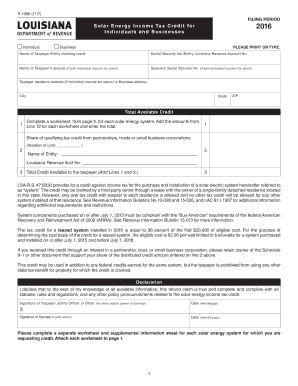

3 and certifies under penalty of law particularly R.S. 14 202. 2 A that the system installed at the residence located at Installer s Name printed Installer s Louisiana License Number Notary Public R-1086-B 3/16 or leased the system and the licensed installer who installed the system. This page should be completed in its entirety and included with Form R-1086. Last 4 digits of SSN Signature Sworn Statements by Licensed Dealer and Installer Pursuant to Act 131 Department of Revenue Form R-1086...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your louisiana solar tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisiana solar tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit louisiana solar tax credit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit louisiana solar energy tax credit form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

LA R-1086 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out louisiana solar tax credit

How to fill out Louisiana solar tax credit:

01

Gather all necessary documentation, including proof of solar panel installation, receipts of expenses related to the installation, and any other required forms or paperwork.

02

Complete and submit Form IT-540 and Form IT-540 Schedule E by the specified deadline, ensuring that you accurately report all relevant information and calculations.

03

Attach any supporting documentation or proof required by the Louisiana Department of Revenue to substantiate your solar tax credit claim.

04

Double-check for any errors or omissions in your tax forms before submitting them to avoid delays or potential penalties.

05

Consider consulting with a tax professional or utilizing online tax software to ensure accuracy and maximize your solar tax credit benefits.

Who needs Louisiana solar tax credit:

01

Louisiana residents who have installed solar panels on their homes or businesses and meet the eligibility criteria may be eligible for the Louisiana solar tax credit.

02

Individuals or businesses who have incurred qualifying expenses for the installation of solar energy systems in Louisiana may benefit from claiming the solar tax credit.

03

Those who wish to reduce their tax liability and potentially receive a tax refund or credit for their investment in solar energy can take advantage of the Louisiana solar tax credit.

Fill la energy credit : Try Risk Free

People Also Ask about louisiana solar tax credit

What are the 5 steps to filing your tax return?

How do I apply for exemption from collection of Louisiana state sales tax?

How to fill out tax return?

How do I fill out where's my refund?

How to fill out Louisiana state tax form?

How many digits is a Louisiana Revenue account number?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is louisiana solar tax credit?

The Louisiana Solar Tax Credit is a state-level incentive program that allows homeowners and businesses in Louisiana to claim a tax credit for installing solar energy systems. This program encourages the adoption of solar power by providing financial benefits to individuals and entities who invest in solar panel installations.

The tax credit allows eligible participants to claim 50% of the cost of their solar energy system, including installation, up to a maximum credit of $9,500. This credit can be applied against the individual or business' Louisiana state income tax liability over a period of five years.

To qualify for the Louisiana Solar Tax Credit, the solar energy system must be installed by a certified solar contractor and meet certain technical requirements. Additionally, the system must be intended for the participant's primary residential or commercial property within the state of Louisiana.

Please note that this information is based on general knowledge and may change over time, so it is always recommended to check with the Louisiana Department of Revenue or a tax professional for the most up-to-date and accurate information regarding the Louisiana Solar Tax Credit.

Who is required to file louisiana solar tax credit?

The Louisiana solar tax credit must be filed by individuals or legal entities who have installed and purchased a qualifying solar energy system in the state of Louisiana.

How to fill out louisiana solar tax credit?

The Louisiana solar tax credit is a state incentive program that provides a tax credit to homeowners and businesses that install solar energy systems. Here are the steps to fill out the Louisiana solar tax credit:

1. Determine eligibility: Make sure you meet the eligibility criteria for the Louisiana solar tax credit. You must own and install a solar energy system in Louisiana between January 1, 2008, and December 31, 2022.

2. Gather necessary documents: Collect all required documents to support your application for the tax credit. This may include proof of purchase and installation costs, system specifications, and any other documentation needed to verify your eligibility.

3. Download the application form: Visit the Louisiana Department of Revenue website and download the Solar Energy System Tax Credit application form. It can be found in the "Forms" section or by using the search function on the website.

4. Complete the application: Fill out the application form accurately and completely. Provide all the requested information, including your personal details, property address, cost of the solar energy system, and any other relevant information.

5. Attach supporting documents: Attach copies of all the required supporting documents to the application form. These may include invoices, receipts, and other proof of purchase and installation costs as well as any additional documents required by the application form.

6. Calculate the tax credit: Determine the amount of your eligible tax credit. The Louisiana solar tax credit is equal to 50% of the first $25,000 of your solar energy system installation costs. The maximum credit allowed is $12,500. Make sure to accurately calculate your eligible tax credit amount.

7. Submit the application: Once the application is complete and all supporting documents are attached, mail the application and supporting documents to the Louisiana Department of Revenue at the provided address on the application form. Make sure to keep a copy of the application and all supporting documents for your records.

8. Wait for approval: The Louisiana Department of Revenue will review your application and supporting documents. If everything is in order, they will approve your application and issue the tax credit. This process may take several weeks or longer, so be patient and keep an eye out for any communication from the department.

9. Claim the tax credit: When filing your Louisiana state tax return for the appropriate tax year, claim the solar tax credit on the specified line of the tax form. Provide the information requested, including the amount of the tax credit you were approved for.

10. Retain records: Keep copies of all the documents related to your solar energy system installation and tax credit application. This will help you in case of any future inquiries or audits by the tax authorities.

Note: It's recommended to consult with a tax professional or accountant for personalized advice regarding your specific situation and to ensure compliance with all IRS and state tax requirements.

What is the purpose of louisiana solar tax credit?

The purpose of the Louisiana solar tax credit is to incentivize and encourage the installation of solar energy systems in the state. It provides a tax credit of up to 50% of the cost of the solar energy system, with a maximum credit of $12,500 per residential system and $50,000 per commercial system. The tax credit helps offset the initial investment cost of installing solar panels, making it more affordable for residents and businesses to adopt cleaner and renewable energy sources. The aim is to promote the use of solar energy, reduce reliance on fossil fuels, lower greenhouse gas emissions, and stimulate the growth of the solar industry in Louisiana.

What information must be reported on louisiana solar tax credit?

To accurately report the Louisiana solar tax credit, the following information must typically be included:

1. Residential solar energy systems: The total cost of installation and purchase of qualified solar energy equipment for your residential property.

2. Commercial or industrial solar energy systems: The total cost of installation and purchase of qualified solar energy equipment for commercial or industrial properties.

3. Start and completion dates: The dates when the installation of the solar energy system began and when it was completed.

4. Solar panel specifications: Detailed information about the solar panels used in the system, including their make, model, wattage, and capacity.

5. Contractor information: The name, address, and federal identification number of the contractor who installed the solar energy system.

6. Tax credit calculation: You need to calculate the eligible tax credit based on the solar energy system's cost, up to the maximum amount allowed by the state. This credit is equal to 50% of the system’s cost, up to $12,500 per residence and $10,000 per commercial or industrial property.

7. Supporting documentation: You should keep copies of any invoices, receipts, or other documentation related to the solar energy system's purchase and installation as a part of your records.

It's important to note that the specific requirements and forms may vary, so it's advisable to consult the Louisiana Department of Revenue or a tax professional for detailed and up-to-date instructions on reporting the solar tax credit accurately.

When is the deadline to file louisiana solar tax credit in 2023?

As of now, there is no specific information available regarding the exact deadline to file the Louisiana solar tax credit for the year 2023. Deadlines for tax credit applications are typically determined by the Louisiana Department of Revenue, and they may vary from year to year. It is recommended to check the official website of the Louisiana Department of Revenue or consult with a tax professional to ensure you have the most up-to-date and accurate information regarding deadlines for filing the Louisiana solar tax credit in 2023.

What is the penalty for the late filing of louisiana solar tax credit?

According to the Louisiana Department of Revenue, if you file the solar tax credit claim form after the due date, you may still be eligible for the credit, but you may incur a penalty of 5% of the total credit amount for each month the claim is late, up to a maximum penalty of 25%. Additionally, interest may also be assessed on the late payment at the rate prescribed by the Louisiana Department of Revenue. It is always recommended to file your tax credit claim on time to avoid any penalties or interest.

How can I get louisiana solar tax credit?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the louisiana solar energy tax credit form. Open it immediately and start altering it with sophisticated capabilities.

How do I complete louisiana solar tax online?

Filling out and eSigning louisiana r 1086 form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit louisiana energy tax online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your r 1086 solar form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Fill out your louisiana solar tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisiana Solar Tax is not the form you're looking for?Search for another form here.

Keywords relevant to la solar tax credit form

Related to louisiana solar credit

If you believe that this page should be taken down, please follow our DMCA take down process

here

.